Get our FREE guide to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances. We’ll implement new technology and processes to modernize your bookkeeping and improve transparency. That helps us ensure your transactions are entered accurately and on time to give you confidence in your decisions.

ALTRUIC® and Helping Nonprofits Create Good® are registered trademarks of Altruic Advisors, PLLC.

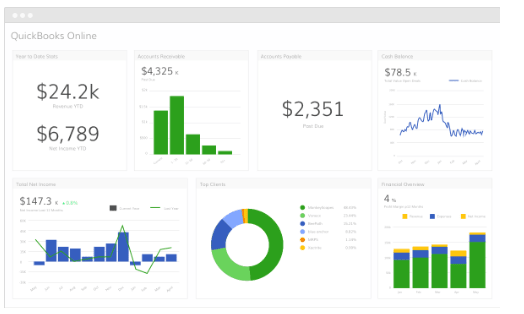

Unlike most software for nonprofits, NonProfitPlus includes inventory management, which is crucial if you stock merchandise (like T-shirts and mugs) to raise money or reward donors. On the other hand, NonProfitPlus doesn’t list any pricing on its site—as with Sage Intacct, you have to get in touch with a representative for a quote. Customers report paying more than $600 a month for NonProfitPlus’s full suite of features, so if you’re looking for affordable nonprofit software, NonProfitPlus probably isn’t it. Since QuickBooks was also made for non-accountants, it’s easy for first-time nonprofit bookkeepers to get a handle on nonprofit finances.

Managing Cash Needs

There also might be compliance requirements related to any licenses you have, as well as charitable solicitation. Many states have laws regarding soliciting funds for charity, and in many cases, organizations accounting services for nonprofit organizations must register before soliciting and must maintain their status by filing periodic reports. This is essential in the nonprofit space, where transparency with donors and other parties is often vital.

“Our work with The Charity CFO has saved our organization money…”

You’ll have secure, 24/7 access to your books and records, from anywhere you have a broadband connection. Write and print checks, sync with your bank account, generate reports…all in the same place. Form 990 is a tax form that tax-exempt organizations—which include most nonprofits—must submit to the IRS every year.

It’s time to fix your nonprofit’s accounting

- Many nonprofits are facing the decision of whether to accept digital assets or miss the chance of substantial donations as digital assets become more popular and easier to access.

- Zoho Checkout is free as long as you accept only 50 donations—ever, not per month.

- Unfortunately, NetSuite’s site is pretty sparse, and it’s definitely on the pricier side of accounting software (third parties estimate it starts at around $499 a month).

- If a 501(c)(3) charitable organization, it is important that the articles contain specific language required by the IRS in terms of charitable purpose and termination.

- Grants are funds that can be awarded for many types of programs and purposes.

Our Outsourced Accounting Services are designed and built for companies that recognize the necessity of upgrading your accounting function. We make sure your business is well-informed and prepped ahead of an external audit. Your message has been received and we’ll be reviewing your request shortly.

What is nonprofit accounting?

You want access to a full-time team at a fraction of the cost of one full-time senior finance leader. You need someone to help ‘run harder’ at accounting and financial initiatives. If you’re asking yourself any of the questions below, let’s connect to start answering them.

- At Business.org, our research is meant to offer general product and service recommendations.

- There’s no better way to understand the value we can bring to your nonprofit than to hear about the results we’ve achieved for other clients.

- Additionally, sloppy or inaccurate accounting can lead to problems with the IRS; such problems include possibly losing nonprofit status, hefty fines and even criminal charges.

- All public companies in the U.S. must follow GAAP, and private companies generally do as well.

Our list of the year’s best free accounting software can help you keep your books in order while you plan for growth. Sage Intacct also offers free seminars to help nonprofit organizers get off the ground, which is particularly useful for nonprofits struggling to make ends meet after COVID-19. And on the review site TrustRadius, Sage Intacct gets 8.6 stars out of 101 with customers indicating they’re happy with Sage’s fast customer service response time. YPTC is not a CPA firm, and provides no attestation services with regard to financial reports. Now, more than ever, financial clarity and transparency are critical to your organization’s success.

However, many nonprofit organizations don’t allocate resources for a professional accountant to manage their finances. Tiffany Couch, CEO of forensic accounting firm Acuity Forensics, says this is one of the biggest mistakes not-for-profit organizations make. When it comes to regulatory bodies, nonprofits need to be aware of reporting requirements from the IRS and the Financial Accounting Standards Board (FASB).

Looking for a Nonprofit Bookkeeping Solution?

However, Sage Intacct is definitely on the pricy end of the nonprofit software spectrum. YPTC offers data visualization services that can help you make data-driven decisions and access the information you need to run your organization from anywhere. Our Management Letter contains specific recommendations and suggestions regarding internal controls and other matters to increase the effectiveness of the client organization. We continue our communication throughout the year to correct identified potential weaknesses, maximize opportunities and assist with any internal challenges to implementation. We believe this proactive advice to be a critical example of the high level of client service the firm provides. It may be hard to believe but getting too much money can sometimes destabilize a nonprofit organization.

Tracking labor and services.

The best accounting software for nonprofits should offer nonprofit-specific features like fund-based accounting, donation tracking, and Form 990 generation. We offer a broad range of services uniquely tailored to nonprofit organizations. What sets YPTC apart is our background in nonprofit-specific financial management. For over three decades, we’ve worked with executive directors and board members across a variety of organizations to fulfill their missions more effectively and efficiently.